This information has been provided by the market regulator, the Financial Markets Authority

For advice about your personal situation, we recommend you speak to an AUTHORISED FINANCIAL ADVISER.

Cash investments are a common way to save money. They’re considered relatively safe because you’re promised a fixed interest rate. But they’re not always the best option – particularly if you’re saving for retirement. Interest rates tend to be low and your money might not grow in value as much as you need it to.

Types of cash investment

Savings accounts and term deposits with a bank, credit union or building society are the most common ways to invest your cash. Another way is through a managed fund (this includes KiwiSaver) which pools together money from individuals for investments, managed by a fund manager.

Savings accounts and term deposits typically guarantee a set level of interest each year. Most basic savings accounts allow you to withdraw your money whenever you want it. A term deposit offers a higher interest rate but you may have to forgo your interest or get lower interest if you withdraw your money before the term finishes. Term deposits can range from three months to five years.

The FMA doesn’t regulate savings accounts or term deposits but they do regulate managed fund providers.

|

Portfolio Investment Entity (PIE) funds are a type of managed fund offered by banks Most banks now offer PIE funds, a type of managed fund that offer investors lower tax rates. If you’re considering investing in a PIE fund, make sure you check the investment terms. There’s usually a penalty for accessing your money early, or in some cases early access may not be possible. You should also see how the PIE fund is invested. The main advantage of managed funds is that your money is spread across a wide range of investments. This is lower risk because you don’t have all your eggs in one basket. However, many bank PIE funds will only invest in their own accounts. |

Things to look out for

Cash investments are a good option if you need to access your money quickly, or if you need your investment to provide a regular income. There are some things you should consider before you invest.

Your investment may not increase by as much as the cost of living

If you have a long-term goal, such as saving towards your retirement, there’s a risk that your money won’t grow as fast as the cost of living. This is known as inflation risk. If inflation increases more than the returns on your investment, your money will have less buying power when you need it.

Fees vary between providers

Providers’ fees vary. The fees also depend on the accounts you choose. Generally, accounts offering higher interest also tend to have conditions attached, such as maintaining a minimum deposit in your account. There may also be penalties for withdrawing money early – such as a break fee, or reduced interest on early withdrawals.

Understand what fees you’ll be paying before you sign up to any product. Because fees are paid out of your investment, differences in fees and charges can have a big impact on your investment over the long term. It’s always a good idea to shop around and get the lowest fees you can.

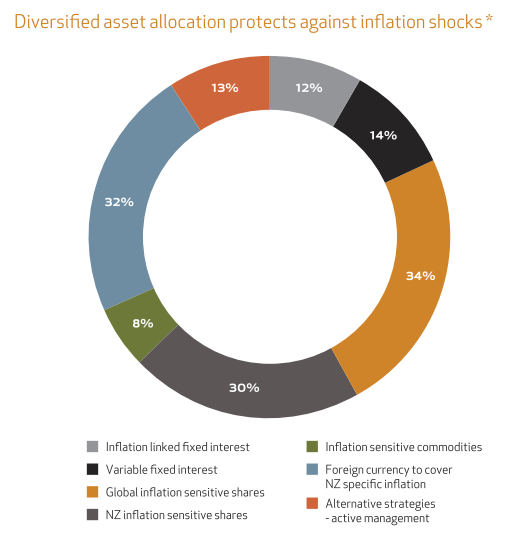

Diversify to reduce your risk

Putting your money with banks is considered one of the safest forms of investment in New Zealand. But there’s no guarantee the banks won’t fail. A good rule is to spread your money across different cash investments. Holding other types of investments such as bonds, property or shares can help reduce the risk of your money’s value being eroded by inflation. If you’re saving for retirement, contributing regularly to KiwiSaver is an easy way to spread your investments.

|

TIP: If you’re investing in cash through a managed fund, like KiwiSaver, it’s worth checking how the provider is investing your money. If the fund is investing in one type of bank deposit account (or a high proportion of assets in that account), you have more risk of losing your money than if it’s spread across different bank deposit accounts. |

Where to get more information

Sorted has further information about investing in bank deposits.