FMA spokeswomen Diane Maxwell said the authority is committed to improving investor understanding of products and services but there are reports that the FMA has no budget to improve financial literacy…

Educating New Zealanders on investing

The FMA partners with other public and private organisations to develop and promote education resources and messages to help investors make better decisions. This includes information about the regulatory regime for investments and the role of the FMA. Other things they do to encourage accurate and relevant information include:

- Reviewing prospectuses for appropriate disclosure about material risks and to reduce the liklihood of them containing misleading or false statements.

- Improving the quality of financial advice by monitoring compliance with the Code of Professional Conduct for financial advisers and the other obligations of advisers.

- Reviewing the quality and usefulness of financial reporting by issuers.

Even if you are good at maths, many of us will struggle with the following calculation:

your standard of living at some future date is the amount you save,

plus compounded earnings,

minus any investment loses,

plus any private and public benefits,

minus the loss of spending power caused by inflation.

Being financially literate is going to help. It’s important to get advice from trusted and Authorised Financial Advisers (AFA’s). Do it right and money planning will be sucessful.

Simple strategies such as regular savings, slow and steady growth and diversification are often the most effective over the long term.

What is financial literacy

Financial literacy is defined as the ability to make informed judgements and make effective decisions regarding the use and management of money. It is about having financial knowledge and having the understanding, confidence and motivation to make financial judgements and decisions.

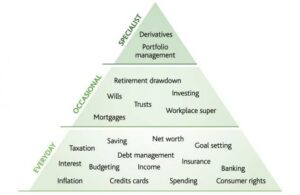

This diagram reflects the range of information and different levels of skill and knowledge that everyone needs to live in a modern economy.

Financial education

An article by Benje Patterson, an economist at Infometrics Ltd, on the NZ finance company sector collapse and financial literacy, states:

- If an adviser had properly diversified their portfolio across different asset classes and sectors, the collapse of the finance compnay sector would have been a temporary blow, rather than a king hit.

- Although a lot of media attention has been placed on the fraudulent behaviour of some finance company directors, the broader issue which this situation has exposed is the financial illiteracy of New Zealanders.

This is a good analysis of a serious issue in New Zealand.