MPS – Global Income, Core Inflation, Dividend & Growth Portfolios plus NZ Funds KiwiSaver Scheme Growth Strategy

Global Income Portfolio

The Portfolio returned -0.37% in December 2015, taking annual performance to 1.03%.

Low interest rates – the ‘new normal’

PIMCO, one of the managers we have used in this Portfolio, coined the phase the ‘new normal’ to explain the economic environment since 2008. This term suggests we are in a period of relatively low (but positive) economic growth and, importantly, low interest rates. In fact interest rates are back to their ‘old normal’. Prior to the period of high inflation in the 1970s, interest rates were typically around 3%. This is likely to be the average return achieved over the next ten years.

Over the past year we have refocused the Portfolio to this new reality. Around 70% of the Portfolio is invested in global investment grade companies. This exposure is both direct and through an external manager, Wellington. This has an expected yield of 6.0%. A further 20% of the Portfolio is invested in United States mortgage-backed bonds. This is one of the few fixed interest asset classes which we feel is offering higher than average risk adjusted returns. This exposure is through three managers – Doubleline, Blackrock and Semper. This portion is expected to yield 7.7%. The remaining 10% of the Portfolio is invested in an alternative manager, Harness, that looks to add value through active foreign currency management.

In developing this new strategy, we knew the Portfolio would be vulnerable to an increase in interest rates and/or an increase in credit spreads (this is the difference between the yield on a corporate and a government bond). This vulnerability was only an issue of timing, for as long as the bonds did not default, the initial unrealised loss would be offset by higher returns going forward. Unfortunately, just after the Portfolio was restructured, both interest rates and credit spreads widened resulting in an unrealised loss. However this initial loss is now resulting in a higher running yield on the Portfolio, with the return achieved over the last three months equal to an annualised return of over 6% pa which is its expected running yield.

Core Inflation Portfolio

The Portfolio returned -1.36% in December 2015, taking annual performance

to -0.31%.

Is low inflation here to stay?

The past year has seen inflation remain relatively low with New Zealand’s Consumers Price Index (CPI) increasing by just 0.4% in the year to September 2015. There are two schools of thought regarding why we may be experiencing low inflation. One suggests we are in a period of structurally low inflation as competitive forces drive prices lower. The development of the internet (which

removes some of the middlemen) and the emergence of cheaper labour from developing nations are the major explanations for this theory. The other school suggests that the world has been hit by a number of one-off shocks which have produced this low inflation result. The recent decline in the price of oil and other commodities would be among these shocks. As always, the truth is likely to

be somewhere in the middle, but the recent rise in global house prices shows that inflation is still alive, just not in the area of consumer prices. Therefore it is important not to become complacent as inflation could surprise on the upside just as it has surprised on the downside in the past year.

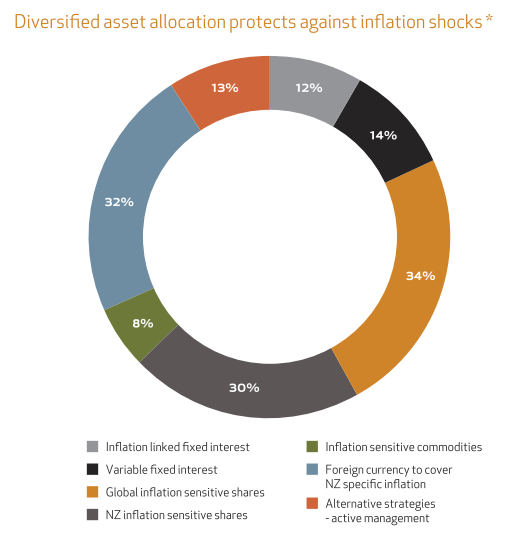

To mitigate the impact of inflation on your investments, the Portfolio looks to hold a diversified range of assets which should perform well in times of inflation. Over the past year, returns from these diversified assets have been mixed. The Portfolio has experienced below average returns from both fixed interest and shares, consistent with returns from these asset classes. The exposure to

foreign currency was beneficial but this has been more than offset by declines in commodities, particularly oil. While the aggregate result has been disappointing this year, it is consistent with the components of the inflation index. This gives us confidence that the construction of the Portfolio is correct for its objective. By definition, a sudden rise in the inflation rate will be due to a shock. It is important that the Portfolio is correctly constructed prior to the occurrence of any shock.

Dividend & Growth Portfolio

The Portfolio returned 1.76% in December 2015, taking annual performance

to 13.00%.

2015 – bouquets and brickbats

The Portfolio had another solid year to date in 2015, posting a return of 13.00%. This was helped by good performance from the New Zealand share market, offset to some extent by a weaker result from its Australian investments.

The biggest contributions to the Portfolio’s return came from two companies involved in the energy sector which were unaffected (even buoyed perhaps) by the lower global oil price. Z Energy continued to grow its earnings and announced a transformational takeover of Caltex New Zealand, while New Zealand Refining benefitted from a positive external environment and changes which management have made there over the past couple of years.

Meridian Energy remains the largest holding in the Portfolio and continues to perform well. Its earnings and dividend should continue to grow modestly over the next couple of years.

The biggest detractors from performance were two media companies, TwentyFirst Century Fox and Sky Network Television. Both are facing disruption from internet TV providers like Netflix. We are conscious of the threat to these businesses and continue to monitor the situation closely.

Rio Tinto shares suffered as the iron ore price continued to fall, but the company remains a best-in-class miner and should happily ride out this commodity cycle, as it has done many times before.

As you may know, we look to invest the Portfolio in a small number of high-quality companies and monitor them closely but hold them for the long term. As per this strategy, there were relatively few changes to the Portfolio during the year. We added two companies and sold out of four.

NZ Funds KiwiSaver Scheme Growth Strategy

The Strategy returned -4.24% in December 2015, taking annual performance

to 7.13%

2015 – return versus risk

After some years of strong returns, global share markets reported reasonably muted returns over 2015. To the end of November, global share markets rose on average by just under 5%. While this may seem disappointing, it actually bodes well for the future, as in previous years share market returns had outpaced the profit growth of the underlying companies. Over the year profit growth caught up, improving the valuation metrics of share markets.

One of the strongest regions over the 11 months to 30 November2015 was Europe which was up 15% on average. The Strategy maintained a large exposure to this region and this was one of the reasons the Strategy achieved a better return. Similarly, one of the worst performing regions was emerging markets (down 3.7%) which the Strategy had minimal exposure to over the year. Another major reason for the Strategy achieving a higher return was the active management of foreign currency exposure. Over the year we reduced the foreign currency hedging in the Strategy, taking active exposure to principally the United States dollar. This was beneficial to the Strategy.

Investing is not all about achieving high returns, as these can be followed by large negative returns. Managing risk is just as important. Over the year we were particularly pleased at our ability to preserve capital during share market declines. The largest decline the Strategy experienced over the 11 months to November2015 was 7.6%, compared with global share markets which on average experienced a decline of 13%. This means you, the client, has a smoother investment experience as well as achieving a higher return than a passive investment in global share markets.