At every review we will revisit your Risk Profile, and together with your age and any spending needs you advise us of, we apply that Risk Profile to our investment recommendations. Each client portfolio is individually tailor made. In every case there will be an appropriate allocation to defensive investment assets which means that any amount exposed to the Growth markets will be appropriate to you, your age and stage in life, and your circumstances.

Each of the 10 Portfolios we have access to across the NZ Funds Managed Portfolio Service investment platform have their own specific objectives, and it’s our job, following a review, to match your objectives with the appropriate portfolios and in the correct weighting in order to provide the best likelihood of you achieving your objectives.

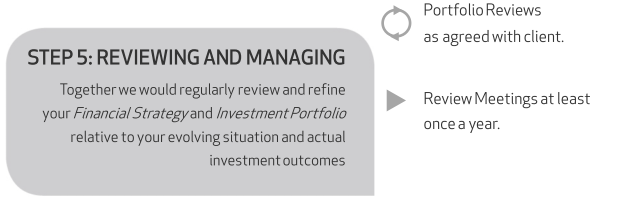

We rely on you advising us of any change in your circumstances in between reviews. We firmly believe that having a portfolio reviewed every 18 – 24 months is the best insurance against the ups and downs of the investment markets over the long term, and significantly improves the likelihood that you will be able to achieve the outcomes you desire from your portfolio in retirement.

It is also important to us that you fully understand the advice process and the assets you are invested in.

We will be in touch to ask you in for a review within our suggested timeframes however please always feel free to contact us if you would like a review anytime. After all, you are paying an advice fee.