Getting on top of it.

If it transpired that your level of debt wouldn’t be paid off until after you retired then we’d have to do something. Sorting the finances seems a good idea. The credit card hangover notwithstanding, the mid year hibernation offers an opportune time for people to reassess their levels of debt, but anytime is a good time to start.

We like the saying ”tomorrow’s good, but today’s better”, meaning it’s important for people to think about their monetary situation and take action as soon as possible. Debt is one of the most significant factors that the average Kiwi needs to deal with. People should plan first, then make decisions about spending or investing. If you don’t have a plan you’re not in a position to make informed decisions about your lifestyle.

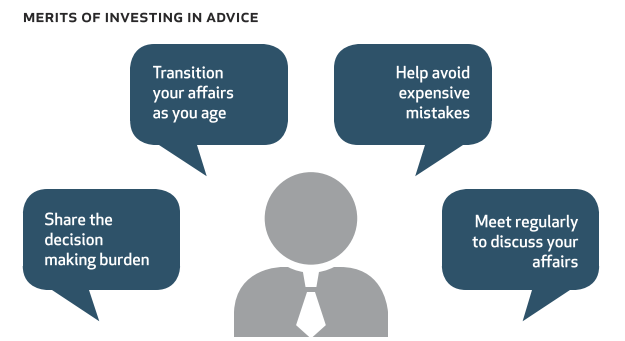

Money (or lack of it) can sometimes be a stressful subject therefore we as Authorised Financial Advisers sometimes become involved in a form of financial counselling. Often our partners/spouse might disagree. They come to the table with different views. There is an element of coaching involved. It’s easier said than done but remind yourself often ”The more you spend today, the less you have later”. It’s about changing habits, and it can take time.

Credit card or store debt is an issue for a lot of people. This is the highest-cost debt, and putting it on the mortgage is not ideal because that extends the debt period, so it is important to get that consumer debt out of the way.

Much of our time as advisers is taken up with the bigger picture, long-range financial planning. Mortgages and retirement savings are top of this list. If I was to sit down with you I’d look at your mortgage, your KiwiSaver situation, your age and your earnings up until when you expect you might retire. If it transpired that your level of debt wouldn’t be paid off until after you retired then we’d have to do something. That might include increasing debt repayments or taking a completely different decision – say, selling your house. We talk about people having a ‘mortgage pledge towards savings’. For instance, if a person paid a mortgage off in 18 years as opposed to, say, 25, and they then saved the same amount as they were paying on their mortgage, what would that mean for them?” Say you had a house worth $600,000 and a 20 year mortgage of $400,000 giving you equity of $200,000. If you were able to pay off the mortgage in 15 years instead of 20 years then you’d have an extra five years of pledged savings.

Let’s look at when you might retire. Take the notional age of 65, the age at which entitlement to KiwiSaver and New Zealand Superannuation begins. However, for the purpose of planning, let’s exclude superannuation because who knows what future governments might do. Now, work out what percentage of your current level of income you’d like to live on in your retirement, say, you are on $100,000 per year and thought you could live on $75,000 per year in your retirement; at 65, you would need to have saved around $1.5 million.

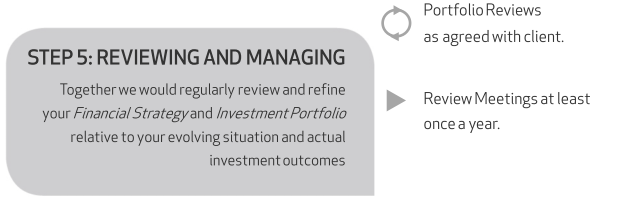

We have software which enables us to sit with you and illustrate your own situation in front of you, creating scenarios tailored to your own circumstances, and it’s free to anyone. For existing clients this software demonstration forms part of the annual review process. We would welcome enquiries and requests from anyone who might like to have their own situation demonstrated either here at our office or in your home, cost and obligation free.

Financial markets have been very volatile over the last few weeks. As of last valuation (28 Aug), the global equity market was down 6.6% month to date (in New Zealand dollars). That follows a bumpy few months with China, Greece, Puerto Rico, oil prices and equity (share) market valuations among the main sources of worry.

Financial markets have been very volatile over the last few weeks. As of last valuation (28 Aug), the global equity market was down 6.6% month to date (in New Zealand dollars). That follows a bumpy few months with China, Greece, Puerto Rico, oil prices and equity (share) market valuations among the main sources of worry.